1 Which of the Following Are Contractionary Fiscal Policies

Increased taxation and decreased government spending C. Higher prices quickly gobble up savings a.

Solved 4 Which Of The Following Is A Contractionary Fiscal Chegg Com

The federal government sends taxpayers up to 300 each in the form of an income tax rebate.

. The government reduces family benefits for high-income families to reduce inequality. Governments engage in contractionary fiscal policy by raising taxes or reducing government spending. Canceling the annual cost of living adjustments to the salaries of government employees D.

Contractionary fiscal policy could consist of a cut in income taxes. Contractionary fiscal policy includes. We review their content and use your feedback to keep the quality high.

Exceed its expenditures in any year. Thats when prices rise too fast in clothing food and other necessities. The government may be crowding out private investments.

Reducing the money supply usually slows down economic growth. C decreases aggregate demand. Supply-side fiscal policies include all of the following EXCEPT.

B increases aggregate demand. Decrease in gov spending. Experts are tested by Chegg as specialists in their subject area.

This is contractionary because consumers and. 2 A contractionary fiscal policy leads to a decrease in the price level. Decreasing money spent on social programs B.

Contractionary Policy as Fiscal Policy. An increase in taxes reduces consumer and business disposable incomes. By reducing the money supply in the economy policymakers are looking to reduce inflation and stabilize the prices in the economy.

The amount by which revenues of the Federal gov. Which are contractionary fiscal policies. Which of the following are contractionary fiscal policies.

One way would be to raise taxes both direct taxes and indirect taxes. Increased taxation and increased government spending Increased taxation and decreased government spending Decreased taxation and no change in government spending No change in. Which of the following would not be an example of contractionary fiscal policy.

Contractionary Fiscal Policy. Economics questions and answers. The federal government builds a new medical research center at a prestigious state university.

What are the expansionary and contractionary fiscal policies Answered. Which of the following is a contractionary fiscal policy. Slow down economic growth.

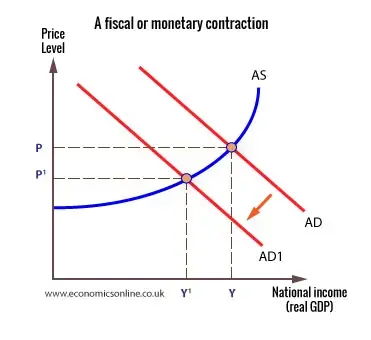

A increasing government purchases. Increased taxation and decreased government spending If the Congress passes legislation to reduce taxes to counter the effects of a severe recession then this would be an example of. A contractionary fiscal policy is administered by increasing taxes and cutting spending which causes the aggregate demand to shift to AD 2 bringing the economy into long-term equilibrium and reducing the price level to PL 2.

Up to 256 cash back Which of the following is considered a contractionary fiscal policy. No change in taxation and increased government spending 2. Increasing income taxes C.

It will create a BUDGET SURPLUS. The purpose of contractionary fiscal policy is to slow growth to a healthy economic level. B close a recessionary gap.

The sales tax on clothing is lifted for one week before the school year begins. An increase in taxes an increase in tax credits an increase in government. A government might want to increase aggregate demand to.

An increase in government spending. The government increases the income tax rate. B increasing government transfers.

The government passes a new law that explicitly changes overall tax rates or spending levels with the intent of influencing the level or overall economic activity. 3 policy options for Contractionary FP. Increasing money spent to pay for government projects E.

D increases aggregate supply. A cut in the budget deficit. Increased taxation and increased government spending B.

The government increases defense spending due to a change in priorities. Which of the following about a contractionary fiscal policy isare CORRECT. Which of the following would be viewed as contractionary fiscal policy.

A leaves aggregate demand unchanged. Which of the following would be considered contractionary fiscal policy. Who are the experts.

A budget deficit or surplus usually determines the type of fiscal policy either as contractionary or expansionary. Which one of the following is least likely a reason to use fiscal deficits as an expansionary tool. Thats between 2 to 3 a year1An economy that grows more than 3 creates four negative consequences.

Contractionary fiscal policy includes. 3 A contractionary fiscal policy is represented by a rightward shift of the AD curve. Note that the goal of contractionary monetary policy is to decrease the rate of demand for goods and services not to stop it.

A direct tax is a tax that is paid straight from the individual or business to the government body imposing the tax. Doing nothing with a temporary budget surplus. Raising the rate the FED lends to banks which in turn makes bank loans more expensive for companies and decreases the money supply.

1 Raising the profits tax rate is an example of contractionary fiscal policy. A close an inflationary gap. Higher interest rates increase the cost of borrowing money which discourages consumers from spending on some goods and services and reduces businesses investment in new equipment.

The inflation level is the main target of a contractionary monetary policy. Decreased taxation and no change in government spending D. C raising tax rates.

The decrease in consumption. D decreasing money growth. If Congress wanted to pursue a contractionary fiscal policy to slow down an overly heated economy it could do so in a couple of ways.

Increasing the reserve requirements of banks which means that these institutions can lend out less money which decreases economic activity. Fiscal policy that decreases the level of aggregate demand either through cuts in government spending or increases in taxes discretionary fiscal policy.

Expansionary And Contractionary Fiscal Policy Macroeconomics

Expansionary And Contractionary Fiscal Policy Macroeconomics

Solved Question 18 1 Point Which Of The Following Best Chegg Com

No comments for "1 Which of the Following Are Contractionary Fiscal Policies"

Post a Comment